ISLAMABAD: IJARA Capital Partners Limited also known as ICPL has established the first Private Equity Fund under a Limited Liability Partnership – LLP system for investments in real estate projects all across Pakistan.

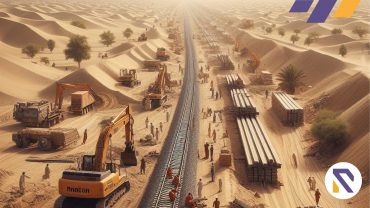

The Fund name is set to be called Tameer Fund with a size of Rs.5 billion. Tameer Fund will fund a broad range of real estate and infrastructure projects/schemes which will enable to deliver liquidity to the real estate sector by largely growing investments by way of bridge funding for land acquisition, project development, and joint ventures.

Tameer Fund will also fund to introduce construction and real estate best techniques from all over the world. In addition to obtaining corporate regularization, legal documentation, and corporate governance to a large informal sector in Pakistan.

In the event of the launching of the latest Private Equity Fund, Farrukh Ansari (CEO of IJARA Capital Partners Limited) announced that being a pioneer of private equity in Pakistan, we feel that the property sector lacks complexity and access as far as the private sector is affected.

Tameer Fund will be a game-changer for the private equity and property markets, delivering a structure and meaning to the stakeholders and the ecosystem including the result of new jobs and attracting fresh FDIs, Farrukh Ansari counted.

IJARA Capital Partners Limited (ICPL) is a private equity & venture capital fund management company of IJARA Group. The management of IJARA has a remarkable track history of turning around companies in the Healthcare and FMCG sectors and strives to continue its legacy of victory in the real estate sector as well.

For more updates on news and real estate blogs, keep reading Realtors Blogs. You can also like us on Medium.