Every person wishes to have their own business from where they can earn a phenomenal amount. Spending money sensibly and strategically is not an easy game. Sometimes you can go through a massive loss, and sometimes it can be beneficial for you. But it depends on how, where, and how much you invest. In this blog we will discuss the top Investment Opportunities in Pakistan and best places to invest in Pakistan in 2024.

There is no doubt the economy of Pakistan is not stable. It remains affected by different circumstances (factors). Due to which many businesses increase, and sometimes it has losses. But the significant and most essential part is understanding where to invest small amounts of money in Pakistan? and where to invest money in Pakistan?

Realtorspk.com is here to answer all your questions by bringing you the top business ideas in Pakistan with small investment.

So, let’s start before any further delay!

List of 10 Best Investment Opportunities in Pakistan:

- Real Estate

- Investment in stocks

- Investment in Bonds

- Investment in Gold

- Forex Trading

- Investment companies and Banks

- Savings Accounts

- Peer to Peer lending

- Investment in Certificate of deposit

- Agriculture and agribusiness

1. Real Estate:

Pakistan real Estate market offers unique opportunities for profitable investment, but there are some things you must consider before investing, like its strategic location, ongoing growth, and rich cultural heritage, which together enhance the appeal of its real estate market. From luxurious apartment complexes to gated communities and strategically placed commercial properties, Pakistan’s real estate projects cater to a range of investment preferences, promising both short-term gains and long-term growth.

Real estate investment stands out as one of the best business opportunity in Pakistan, particularly in the major cities like Peshawar, due to its potential for quick and significant returns. You can always opt to invest in profitable real estate projects in Peshawar. Over time, the value of these properties tends to increase, making this a lucrative investment strategy.

While talking about investment in real estate, investing in commercial properties is considered more profitable. One might consider investing in commercial areas in Islamabad as it offers profitable opportunities with higher returns on investment compared to residential properties. This city’s growing economy and infrastructure make it an ideal spot for commercial investments.

Investing in real estate can be a game-changer, especially with a successful real estate agent by your side. These agents are crucial in guiding you through the buying and selling process and understanding the market’s ups and downs. They’re the go-to experts who help turn property investments into profitable ventures by making informed decisions.

The best thing about real estate investment is it’s advantageous and one of the safest investment opportunities in Pakistan. For the last few years, it’s noticed the real estate industry remains growing very fast and leaving a positive impact on the economy of Pakistan and one of the best places to invest in Pakistan.

2. Investment in stocks:

Stock investment is considered one of the most lucrative investment opportunities in Pakistan. The Pakistani stock market claimed a profit of around 259 billion last year. The banks have reported a record profit of 81 billion rupees in the first quarter of 2024. It is stated that overall, 19% profitability has increased quarterly.

Investors can start investing from the lowest possible amount, and there is no limit to the maximum. However, knowing the strategies for investing in stocks is important before spending your savings. Stocks are profitable yet risky investment options and can only be profitable once you know the tactics to invest. It is recommended to build a wider portfolio to minimize the overall risk while investing in stocks.

Typically, the most expensive stocks have higher risks, but they appeal with higher ROI. It is better to start from cheaper stocks or if you have little knowledge about the stock market, try to hire a broker.

3. Investment in Bonds:

Treasury bonds are a safe investment opportunity to invest in Pakistan. With the investment, you can get a fixed rate of interest that is paid until the bond maturity. The steady returns help to consistent passive income and offset the instability of prices.

The Pakistan government issue treasury bonds that start from as minimum as 100 rupees, with the current revenue of around 13.257%. The bond investment provides many benefits as you can win prizes of thousands of rupees or keep bonds safe as an alternative for cash. Student bonds are known as the smartest and easiest investment ideas in Pakistan. The government of Pakistan guarantees bonds. Therefore, there are very few risks involved in the payouts.

4. Investment in Gold:

With the fluctuation in the value of the Pakistani rupee and its continuous fall, gold has emerged as the safest investment option. Gold prices have hit a high of 135,500 per tola in Pakistan. According to the statistics, gold prices will continue to rise as a barrier to inflation. Investing in gold bricks can generate substantial revenue.

Investment in gold is considered a better option than silver as the prices of silver have not changed for long in the current economic cycle.

5. Forex Trading:

Forex trading is a lucrative option to invest in Pakistan. The trading refers to the trading of different currencies. Investment in currencies is an attractive option as it is convenient and easy compared to stocks. However, with proper study and observing the latest currency trends, the investors generate more revenue.

For instance, consider the example of the American dollar. In 2018 the average price of one dollar was 140 rupees, and now it has crossed 200 rupees. So it is better to invest according to the financial situation and currency trends and generate revenue. Investors can invest with as low as 1000 rupees.

6. Investment companies and Banks:

Investing in banks and financial institutions is a popular option for profit in Pakistan. Just follow these steps: open an account, deposit funds, and start investing monthly. Many banks offer annual returns between 10% to 12%.

However, if you’re considering a larger investment, like purchasing a home, understanding which banks provide home loans is crucial. Here’s a list of top banks providing home loans in Pakistan:

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- Muslim Commercial Bank (MCB)

- Allied Bank Limited (ABL)

- Bank Alfalah

Each bank has its unique selling points, from interest rates to loan tenure and processing fees. It’s advisable to research and compare these options to find the best fit for your home buying needs.

7. Savings Accounts:

Saving accounts are one of the classy yet trendy investment ideas in Pakistan. A saving account is a bank account type in which you deposit money to keep it safe and withdraw it while earning interest. Many banks offer saving accounts, and many institutions and companies offer this attractive opportunity to invest. However, banks, credit unions, and financial institutions insured by Federal Deposit Insurance Corporation (FDIC) can offer the facility.

Saving accounts require a minimum of 100 rupees; therefore, it is the most appropriate money-saving opportunity for people of all ages. The interest rate on saving accounts is different in every bank, and it varies from 4.15% to 11%. It means on a 500 deposit; you can get 556 with 11% interest.

While saving accounts remain a popular choice in Pakistan, offering a secure way to store funds and accrue interest, they are not the only avenue for smart investing. Among the multitude of options, identifying the best cities to invest in real estate in Pakistan is crucial.

8. Peer to Peer lending:

P2P lending, or Peer to Peer lending, enables the person to obtain loans from others, cutting financial institutions as the middle person.

In easy words, if you have some cash in the bank, like 50,000 to 1 lac, you can multiply it by lending it to others at a mutually-agreed interest rate. You can also decide the time period of return and other clauses accordingly.

It is a simple investment option; however, it is one of the risky investment options in Pakistan. You can start investing by lending to people you trust and know well. Also, it is important to document the details of the loan accordingly. You can invest from as low as 10,000 rupees to start generating revenue.

9. Investment in Certificate of Deposit:

A certificate of deposit is a financial mechanism offered by almost every bank in Pakistan. CD is issued by banks to a person when they deposit money in the account for a certain period of time to generate a specific amount of interest.

Deposit certificates are considered safe and high-yield investment opportunities in Pakistan. Therefore, many people tend to invest in CDs for the future.

There is only one downside of investing in a Certificate of Deposit, i.e., once you have deposited the money in the bank, you cannot withdraw it for a specific amount of time. Still, it is a good choice for long-term investment. Investors can invest at least 500 rupees in Certificate of Deposit in various banks.

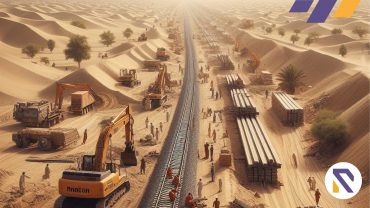

10. Agriculture and Agribusiness:

Agriculture and agribusiness are highly lucrative investment opportunities in Pakistan due to the country’s fertile land and promising climatic conditions. You can invest in any of the following sub-sectors of agriculture.

With the increasing need for efficient land use, vertical Farming presents an innovative approach. It maximizes yields in limited spaces. Therefore, you can get the most out of a small piece of land.

The mounting concern and demand for pesticide-free food options is rising globally. Consequently, the consumer’s need for organically grown food is growing. Investing in organic Farming aligns with current market trends and fulfills the increasing demand for chemical-free, high-quality agricultural products. Moreover, organically grown foods are more expensive than regular food items. So, your profit margin will be high.

The livestock industry in Pakistan offers substantial investment potential. You can start breeding goats, sheep, cattle, and buffalo. The profit from livestock farming mainly comes from

- Export of meat, leather, etc

- Meat and dairy supply in the local market

- Selling cattle for the Eid-ul-Adha

With high demand in local, national, and international markets, livestock farming is a golden opportunity for investors to capitalize on the rising demand of consumers.

Conclusion:

In conclusion, if you’re wondering how to make a profitable investment in Pakistan, the opportunities discussed here offer promising avenues. These investments are not only growing swiftly but are also positively impacting Pakistan’s economy. We hope this guide has provided valuable insights for your financial activities.

Read More Related Blogs :