In Pakistan, the National Tax Number (NTN) serves as a key identifier for individuals and businesses engaged in taxable activities, making NTN verification a crucial step for compliance with the country’s tax regulations. This process ensures that one’s tax status and identity are accurately recorded and recognized by the Federal Board of Revenue (FBR), the body responsible for tax collection and policy. With advancements in technology, online NTN checking and verification have simplified this once-burdensome process.

Now, taxpayers can easily verify their NTN status from the comfort of their home or office, ensuring they remain on good terms with the FBR. This development not only promotes transparency and ease of doing business but also encourages a culture of tax compliance among the Pakistani populace. As we discuss further the significance and process of NTN verification in Pakistan, it’s clear that utilizing these online facilities is beneficial for both the authorities and the taxpayers.

What is NTN?

The National Tax Number (NTN) plays a key role for individuals and corporations engaging in taxable transactions within Pakistan. Essentially, it serves as registration with the Federal Board of Revenue (FBR), the principal body overseeing tax collection and policy throughout the country. By securing an NTN, taxpayers gain legal recognition, allowing them to file tax returns, engage in import or export activities, and meet other financial commitments necessitating official acknowledgment.

Who Issues NTN in Pakistan?

The National Tax Number (NTN) in Pakistan is issued by the Federal Board of Revenue (FBR). The FBR is responsible for tax administration and enforcement across the country.

Issuing NTNs aligns with governmental aims to broaden the tax base and ensure that all economic activities contribute to the nation’s treasury. The responsibility for NTN issuance rests squarely with the FBR, positioning it as the central authority for NTN in Pakistan. This system not only streamlines tax collection but also helps individuals and businesses access various tax advantages and exemptions. As a result, it fosters a culture of compliance and financial integrity.

Moreover, the NTN system plays a pivotal role in combating tax evasion, enhancing the efficiency of tax administration, and promoting fairness in the tax system. It’s a fundamental component of Pakistan’s strategy to modernize tax governance and expand its revenue system, marking a significant step toward economic stability and growth.

How to Verify NTN Online

Verifying your National Tax Number (NTN) online is a straightforward process, thanks to the Federal Board of Revenue’s (FBR) digital services. This guide will walk you through the necessary steps using official platforms.

Online NTN Verification by CNIC

To begin the process of FBR online NTN verification, start by visiting the official FBR website. Here’s how to navigate the portal for NTN verification:

- Visit FBR’s Official Website: Go to the Federal Board of Revenue’s official website at https://fbr.gov.pk/.

- Navigate to the “Taxpayer’s Portal”: Look for a section or link to the Taxpayer’s Portal or Services. This might be labeled as “Online Services” or something similar.

- Select “Online Verification Option”: Within the portal, find and select the option “Taxpayer Profile Inquiry”. This section allows you to check the status of your NTN using various identifiers.

- Enter Your CNIC Number: When prompted, enter your CNIC number without dashes. Ensure the number is accurate to proceed with the verification process.

- Complete the CAPTCHA Verification: If there’s a CAPTCHA, complete it to prove you’re not a robot. This step is essential for security and to proceed.

- Submit the Information: After entering your CNIC and passing the CAPTCHA (if applicable), click the submit or verify button.

- View NTN Details: If your CNIC is registered, your NTN details will be displayed. This includes your NTN number, name, and other relevant tax registration details.

- Print or Save the Details: You have the option to print or save the information for your records.

This digital facility is part of the FBR’s initiative to make tax services more accessible and to streamline the process of how to check online NTN verification by CNIC in Pakistan.

How to Get NTN Certificate?

Obtaining your NTN certificate is also possible through this process. Once your NTN has been verified and displayed, you often have the option to download a formal NTN certificate directly from the portal. This certificate is crucial for various financial and business-related activities, serving as proof of your registration and compliance with tax laws in Pakistan.

By following these steps, individuals and businesses can easily verify their NTN status online, ensuring they remain compliant with Pakistan’s tax regulations.

Why is NTN Verification Important?

Ensuring your National Tax Number (NTN) is verified is more than a regulatory formality; it’s a critical step for individuals and businesses in Pakistan, underlined by tangible benefits and essential for maintaining compliance with the Federal Board of Revenue (FBR). With over 2.5 million active taxpayers registered with the FBR as of 2023, the importance of staying verified and compliant has never been more emphasized.

Individuals gain significantly from online NTN verification, as it serves as a key to unlock several financial privileges. For instance, verified individuals can expedite the process of loan approvals, property transactions, and even visa applications, as it stands as proof of their fiscal responsibility. Given that the FBR has facilitated online NTN verification, the process is straightforward and accessible, ensuring that individuals can maintain their tax status without hassle.

The stakes are equally high for businesses. With FBR online NTN verification, companies can solidify their credibility and financial integrity. This verification is pivotal for applying for tax credits and refunds, which, in fiscal year 2022-2023, amounted to billions in the Pakistani economy. Moreover, a verified NTN status enhances a business’s eligibility for government tenders and grants, nurturing trust among investors, partners, and customers alike.

The process of NTN verification, easily conducted online, is not just about adhering to tax laws; it’s about actively participating in Pakistan’s economic growth. With the FBR’s continuous efforts to streamline tax processes, ensuring your NTN is verified is a straightforward yet impactful step toward financial security and credibility.

Online Resources for NTN Verification

For those needing to verify their National Tax Number (NTN) or obtain an NTN certificate, a range of online resources are at your disposal. Officially, the Federal Board of Revenue (FBR) is your go-to platform for anything related to NTN verification online. Their website offers a straightforward process for individuals and businesses to verify their NTN status or to download their NTN certificate. By entering specific details such as your CNIC number, businesses and taxpayers can easily access their tax-related information. This move towards digitization not only reflects the government’s commitment to improving tax administration but also simplifies the process for over 1.5 million active taxpayers, as reported in the latest fiscal year.

Beyond the FBR’s official portal, there are other websites and online services that provide assistance in NTN verification and obtaining NTN certificates. These platforms might offer additional guidance, comprehensive FAQs, and step-by-step instructions tailored to those who are less familiar with the FBR’s system. While these unofficial sites can be helpful, especially for users seeking more detailed explanations or facing issues with the official portal, it’s crucial to verify the authenticity of the information provided to ensure compliance with Pakistan’s tax laws.

Whether you choose the official FBR portal or turn to other reputable online resources, verifying your NTN and obtaining your NTN certificate online has never been more accessible.

How to Check FBR Filer Status Online

Verifying your status as a filer with the Federal Board of Revenue (FBR) is a crucial step for taxpayers in Pakistan. Being recognized as an active taxpayer not only streamlines your financial dealings but also affords you eligibility for reduced tax rates and exemptions on various transactions. The FBR has made this verification process straightforward and accessible through its online platform.

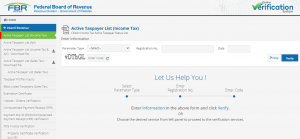

To check your filer status, simply visit the FBR’s official website and look for the ‘Active Taxpayer List (ATL)’ section. Here, you’ll find the “FBR filer status check online” feature. By inputting your National Tax Number (NTN) or Computerized National Identity Card (CNIC) number, the system promptly displays your filer status.

This facility is provided free of charge and designed to encourage compliance with tax laws. According to the latest figures, the ATL includes millions of individuals and companies, underscoring the government’s commitment to enhancing tax collection and compliance. Being on this list means you’re part of a growing number of Pakistanis who enjoy benefits such as reduced withholding tax rates on banking transactions and eligibility for tax credits.

The simplicity and immediacy of checking one’s filer status online demonstrate the FBR’s efforts to improve technology for more efficient tax administration. The aim is to increase the number of active taxpayers and ensure a fair tax system for all.

Conclusion

Understanding how to verify online NTN is more than just following steps; it’s a way to support a culture of tax compliance and transparency in Pakistan. NTN verification makes sure that individuals and businesses are recognized by the FBR, making financial transactions smoother and helping comply with local tax laws. In an era where digital solutions make complex processes easier, the ability to verify NTN online not only simplifies tax-related tasks but also encourages a responsible approach to paying taxes. This shift to digital verification shows Pakistan’s effort to use technology in governance, aiming to increase tax collection and ensure everyone contributes fairly to the economy.

Read More:

- How to Check Property Tax in Pakistan

- Property Registration Process in Pakistan

- Steps to Get Power of Attorney in Pakistan